Riyadh Defines New Zones for White Land Fees

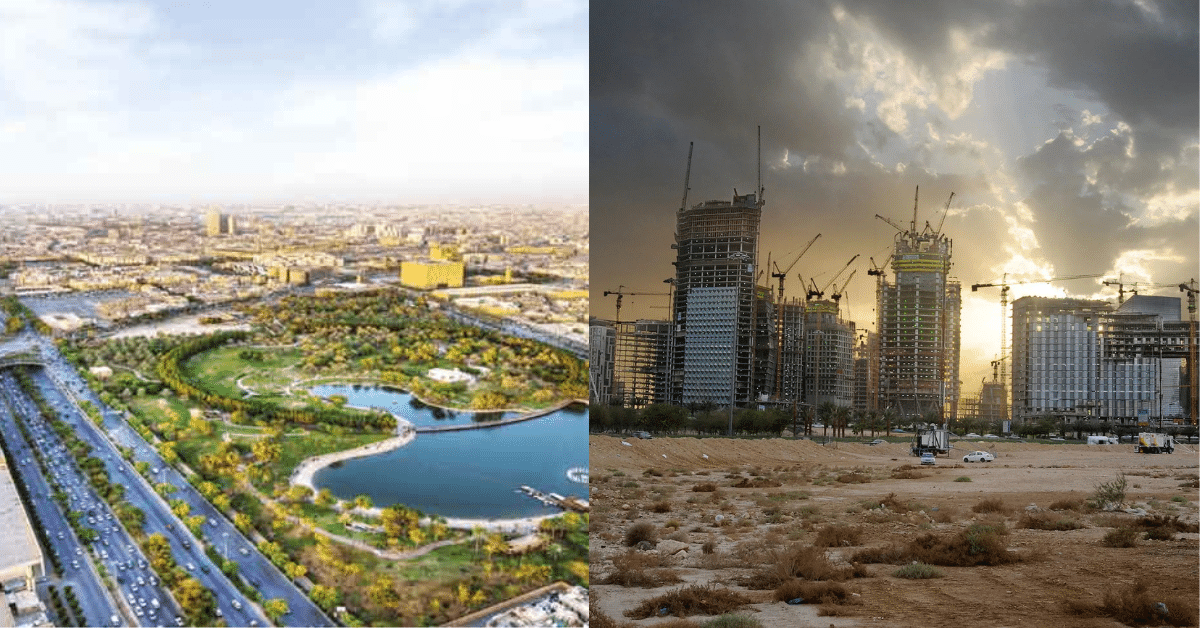

On August 28, 2025, the Ministry of Municipal and Rural Affairs and Housing announced the designation of new zones for the application of white land fees in Riyadh. This marks a significant step aimed at balancing the real estate market and guiding urban growth in the capital.

New Fee System

Minister Majid Al-Hogail explained that the new phase introduces annual fees on undeveloped plots within the official urban boundary. These fees are applied according to five categories:

- Zone 1: 10% of land value

- Zone 2: 7.5% of land value

- Zone 3: 5% of land value

- Zone 4: 2.5% of land value

- Outside priority zones: exempt from fees, but still counted toward the owner’s total undeveloped land holdings in the city

Implementation Criteria

The program covers all land uses within the city’s official urban limits. A minimum area of 5,000 square meters is required for fees to apply. This is applicable whether as a single plot or as the combined holdings of one owner.

A specialized technical committee of accredited valuers from the Saudi Authority for Accredited Valuers will be tasked with assessing land values and setting development timelines. Committee terms are set at three years and are renewable.

Annual Market Review

The ministry confirmed that it will conduct yearly reviews covering land and housing availability, market activity, price levels, and monopolistic practices. Based on these findings, it may adjust, suspend, or expand the scope of the program. This will be done in line with urban development priorities.

✦ ArchUp Editorial Insight

The article outlines Riyadh’s white land fee program as a regulatory tool designed to recalibrate the real estate market. The five-tier structure distributes fees across priority zones. This reflects an effort to impose clearer urban order. Yet, a critical question arises: can percentage-based taxation alone ensure tangible land development? Or should stronger mechanisms tied to contextual demand be considered? The program risks remaining numerical rather than spatially grounded. Nevertheless, its provision for annual market reviews introduces a flexible framework. This allows adjustments in response to evolving urban dynamics and ensures that the policy holds relevance for the city’s long-term development strategies.