U.S. Mortgage Rates Drop to Lowest Level in 2025

The average interest rate on 30-year mortgage loans in the United States fell this week to its lowest level of 2025, offering a positive signal for potential homebuyers.

Current Rates and Weekly Changes

According to Freddie Mac, the average interest rate for 30-year mortgages is 6.15% this week, down from 6.18% last week and 6.91% during the same period last year.

Meanwhile, the 15-year mortgage rate, favored by homeowners looking to refinance their current loans, dropped to 5.44% from 5.50% last week and 6.13% a year ago.

Factors Influencing Mortgage Rates

Freddie Mac noted that mortgage rates are influenced by several factors, including Federal Reserve interest rate decisions and bond market investors’ expectations regarding the economy and inflation.

Mortgage rates are also affected by the yield on 10-year U.S. Treasury bonds, which lenders use as a benchmark. The 10-year Treasury yield stood at 4.14% in mid-session yesterday, slightly down from 4.15% last week.

✦ ArchUp Editorial Insight

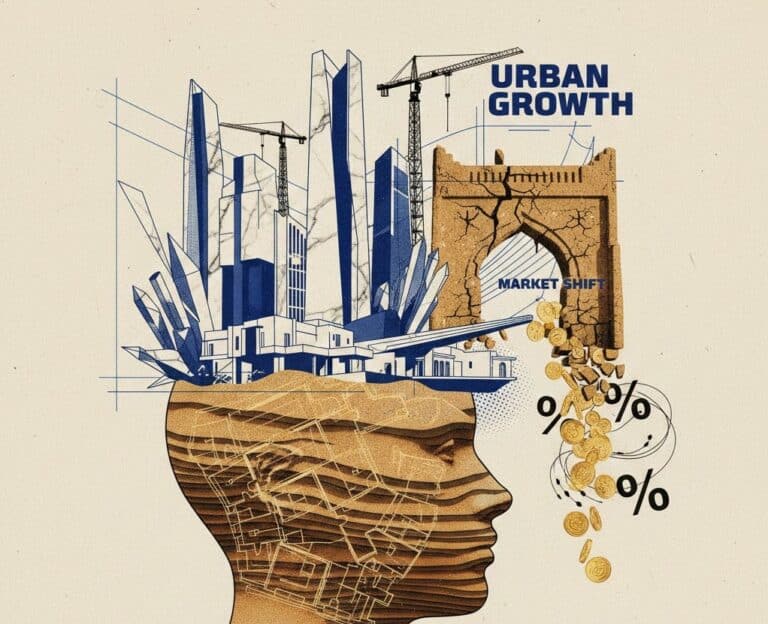

The recent decline in U.S. 30-year mortgage rates to 6.15% illustrates a subtle yet significant shift in Contemporary residential finance, directly affecting the spatial dynamics of housing markets and the accessibility of standardized suburban and urban developments. Lower borrowing costs enhance Functional Resilience for potential homebuyers, providing renewed capacity to engage with the housing stock while influencing Material Expression through demand-driven construction patterns. However, these rate reductions, shaped by Federal Reserve policy and Treasury yields, raise questions about the sustainability of market expansion and long-term affordability, particularly amid ongoing economic volatility. Ultimately, the trend underscores an architectural and economic ambition to align financing mechanisms with urban growth, fostering a responsive yet resilient housing ecosystem.