Banan Real Estate Signs MoU to Establish Private Real Estate Investment Fund

On December 25, 2025, Banan Real Estate signed a memorandum of understanding (MoU) with Artal Financial and Rakan Al-Tasan to establish a private real estate investment fund compliant with Shariah principles and licensed by the Saudi Capital Market Authority, aimed at acquiring a 3,278.8-square-meter land in Al-Rahmaniya District, owned by Qimam Nashz Real Estate Development, a subsidiary of Banan.

Project Details

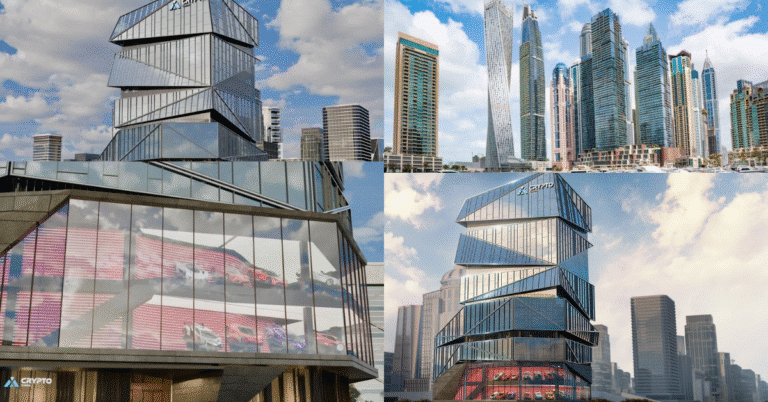

According to a statement published on Tadawul Saudi, the MoU includes the creation of a hospitality project on the land, with Banan Real Estate appointed as the exclusive developer and marketer, overseeing development and execution, and Artal Financial appointed as the fund manager.

Fund Shares and Agreement Duration

The fund’s shares will be equally divided between Qimam Nashz Real Estate Development and Rakan Ibrahim Al-Tasan. The agreement lasts for three calendar months from the signing date, with the possibility of extension upon written consent of all parties.

Expected Financial Impact

Banan Real Estate expects the positive financial impact to appear in its results upon actual project implementation, mainly through revenues generated from development activities.

✦ ArchUp Editorial Insight

Banan Real Estate’s MoU to establish a Shariah-compliant private investment fund reflects a Contemporary real estate development model where financial structuring and regulatory alignment directly inform the execution of urban projects. The planned hospitality development on the 3,278.8-square-meter Al-Rahmaniya site exemplifies Material Expression shaped by investment frameworks rather than purely architectural ambition, situating the project within a controlled urban fabric. However, questions of functional resilience and contextual relevance arise, as the project’s impact on the surrounding district will depend on integration with local infrastructure and market absorption. Ultimately, the initiative illustrates an architectural ambition mediated by finance and governance, demonstrating how strategic partnerships and regulatory compliance can drive sustainable development while balancing economic returns and urban planning objectives.