U.S. Existing-Home Sales Surge in December 2025 Signals Market Recovery

Existing-home sales in the United States rebounded sharply in December 2025, posting their strongest seasonally adjusted pace in nearly three years, as mortgage rates eased and home price growth moderated, helping to relieve a market previously frozen by affordability pressures.

Broad-Based Sales Improvement

According to the National Association of Realtors (NAR), sales rose 5.1% from November to a seasonally adjusted annual rate of 4.35 million units, marking a 1.4% increase year-on-year. All four major U.S. regions saw month-over-month gains, with the South leading annual growth at 3.6%, while the Midwest and West remained steady and the Northeast declined.

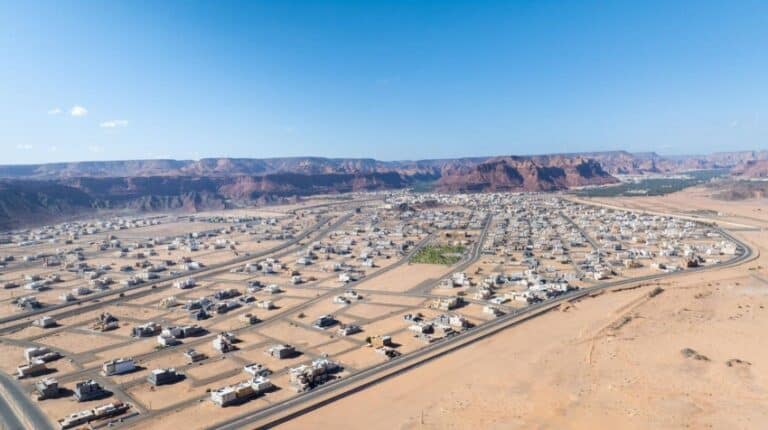

Supply Constraints and Urban Planning Implications

Despite rising demand, supply constraints remain a key market feature, with total housing inventory falling to 1.18 million units, representing a 3.3-month supply at the current sales pace. For architects and urban planners, this highlights the need for flexible housing designs and mixed-use projects to address limited supply and improve urban efficiency.

Prices and Mortgage Rates

National home prices continued to rise modestly, with the median existing-home price at $405,400, marking 30 consecutive months of annual increases. The average 30-year mortgage rate fell to 6.19%, providing some affordability relief and encouraging buyers to re-enter the market.

Architectural and Urban Outlook

The late-year rebound suggests that housing activity may be stabilizing as borrowing costs retreat, calling for architects and planners to focus on:

- Flexible residential designs to adapt to shifting demand

- Optimized public spaces and amenities

- Integrating sustainability and energy efficiency into new buildings

- Planning projects that respond to affordability dynamics and a changing housing market

✦ ArchUp Editorial Insight

The December 2025 rebound in U.S. existing-home sales illustrates a cautious recovery within Contemporary Residential Development, driven by moderating mortgage rates and tempered home price growth. While market activity surged across all major regions, persistent supply constraints highlight critical Functional Resilience challenges, emphasizing the need for flexible housing typologies, mixed-use schemes, and adaptive urban strategies. However, the imbalance between rising demand and limited inventory raises questions of Contextual Relevance, as new developments must integrate seamlessly into existing urban fabrics while responding to affordability pressures. Ultimately, this phase signals an opportunity for Architectural Ambition, enabling architects and planners to craft energy-efficient, adaptable, and socially responsive designs that reinforce urban efficiency and long-term livability.