The Architect as Fiduciary: Why Seniority Demands Financial Mastery

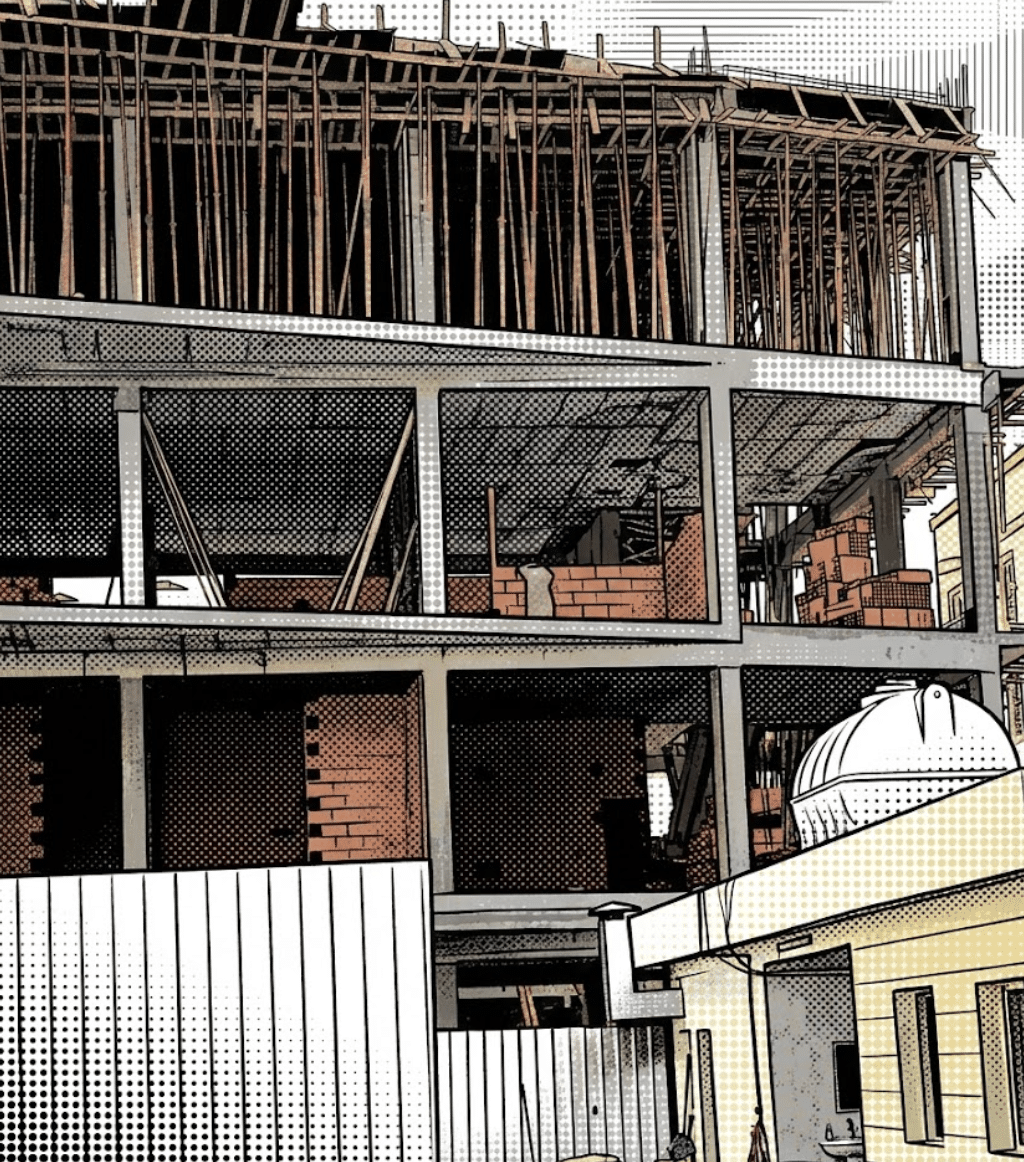

In the nascent stages of any project, the atmosphere is one of creative optimism. The Lead Architect sits at the center of the Design studio, speaking of proportions, the play of light, and the delicate relationship between space and the human inhabitant. At this level, the dialogue with the client is visionary. It is an exercise in pure ideation. However, as the project migrates from the screen to the soil, the role undergoes a radical, often unvoiced transformation. The same individual who was debating phenomenology and materiality suddenly finds themselves confronted by payment schedules, certificates of work, and contractors waiting for a signature before the week ends.

This is the silent pivot of the profession. The Lead Architect ceases to be merely a design authority and becomes, by necessity, the financial guardian of the project.

The weight of the architect’s signature shifts from aesthetic approval to legal and financial commitment. Every interim payment certificate (IPC) that passes across their desk represents a massive transfer of capital from the owner to the contractor. Any error in judgment, any miscalculation of quantities, or any failure to vet a material substitution can lead to a budget overrun, a legal dispute, or a delay that cannot be recovered. In this phase, the client rarely asks about the “why” of the concept. They ask about the logic of the expenditure. They ask if the material on site matches the specification or if it is merely a cheaper alternative masquerading as quality.

This transition is not optional. It is an inherent structural reality of seniority. As one rises through the ranks of a firm or takes on larger Projects, the responsibility for the budget doubles. The Lead Architect is the final line of defense before a design turns into an open-ended invoice. Engaging in financial minutiae is not a betrayal of the creative spirit. It is its most practical extension.

The data surrounding this shift is sobering. According to global industry benchmarks, approximately 60 to 70 percent of large-scale construction projects exceed their original budgets, with a significant portion of these overruns occurring during the transition from the “concept” to “detailed design” phases. Furthermore, studies in Architectural Research suggest that while architects are responsible for only a small fraction of the total project cost in fees, their design decisions influence up to 90 percent of the project’s total life-cycle costs.

This leads to a sensitive question: What happens to the architect who is brilliant at design but illiterate in the language of numbers? The reality is that they do not get a pass. A lack of financial understanding does not eliminate the liability; it merely multiplies the risk. We have seen countless masterpieces fail during Construction because of poor cash flow management or a lead architect who relied too heavily on the reports of others without understanding what the figures actually meant.

There is an internal conflict that many practitioners face. They fear that the “managerial” turn will erode their innovative edge. But if we look closer at the history of Architecture, the architects who mastered the site and the ledger were often the ones whose visions actually survived. The architect who separates design from execution entirely often produces work that is beautiful on paper but fragile on the ground. Conversely, the architect who understands that design responsibility extends to the last cent spent tends to design with a “practical eyes” that does not necessarily sacrifice poetry.

This process can be compared to the switching of hats. During the initial phases, the architect wears the hat of the creator. They are allowed the freedom of experimentation and the luxury of the “what if.” But upon entering the execution phase, they must temporarily set that hat aside and put on another: the hat of time, cost, and fiduciary responsibility. The problem in the industry today is not the act of switching hats, but the refusal to do so, or the attempt to wear only one hat throughout the entire journey.

Paradoxically, this financial pressure can be a catalyst for innovation rather than its killer. When an architect knows that every design decision has a direct fiscal impact, they begin to think more strategically. They ask how the same emotional effect can be achieved with a more efficient structural system. They ask how to keep the core of the idea alive without bankrupting the client. This is where innovation moves from visual luxury to strategic necessity, particularly in the context of Sustainability, where cost-efficiency and material responsibility are paramount.

In the evolving landscape of 2026 Cities, the Lead Architect is no longer a lone artist. They are a hybrid professional. As projects grow in complexity and scale, hiding behind sketches is no longer an option. Finance is the second language of architecture. Those who refuse to learn it are not protecting their creativity. They are leaving it vulnerable to the first person who knows how to read a spreadsheet.

Ultimately, the goal is not to turn architects into cold accountants, but to ensure they are the ones controlling the narrative of the project until the keys are handed over. To be a leader in architecture is to understand that the beauty of a building is inseparable from the health of its budget. The architect who masters the money is the only one who truly protects the art.

✦ ArchUp Editorial Insight

The transition from ideation to execution is governed by a pivot from aesthetic authority to fiduciary responsibility. Financial pressures—specifically the 60-70% risk of budget overruns in large-scale Projects—institutionalize a decision framework where the architect functions as the primary risk-mitigation node. Data layering reveals that while design fees are marginal, early-phase decisions dictate 90% of a building’s total life-cycle costs, making financial mastery an operational prerequisite for seniority. Consequently, the architectural outcome is no longer a standalone concept but a symptom of construction cash flow and procurement vetting. Defensive behaviors in the studio, such as the refusal to engage with spreadsheets, inevitably produce “fragile” built environments vulnerable to material substitutions. In 2026 Cities, architectural form is the logical byproduct of capital management; the building is a physical ledger where the resolution of poetic intent is directly proportional to the health of the budget.