New Trump Tariffs: A Deep Dive into the Impact on Construction and Architectural Projects

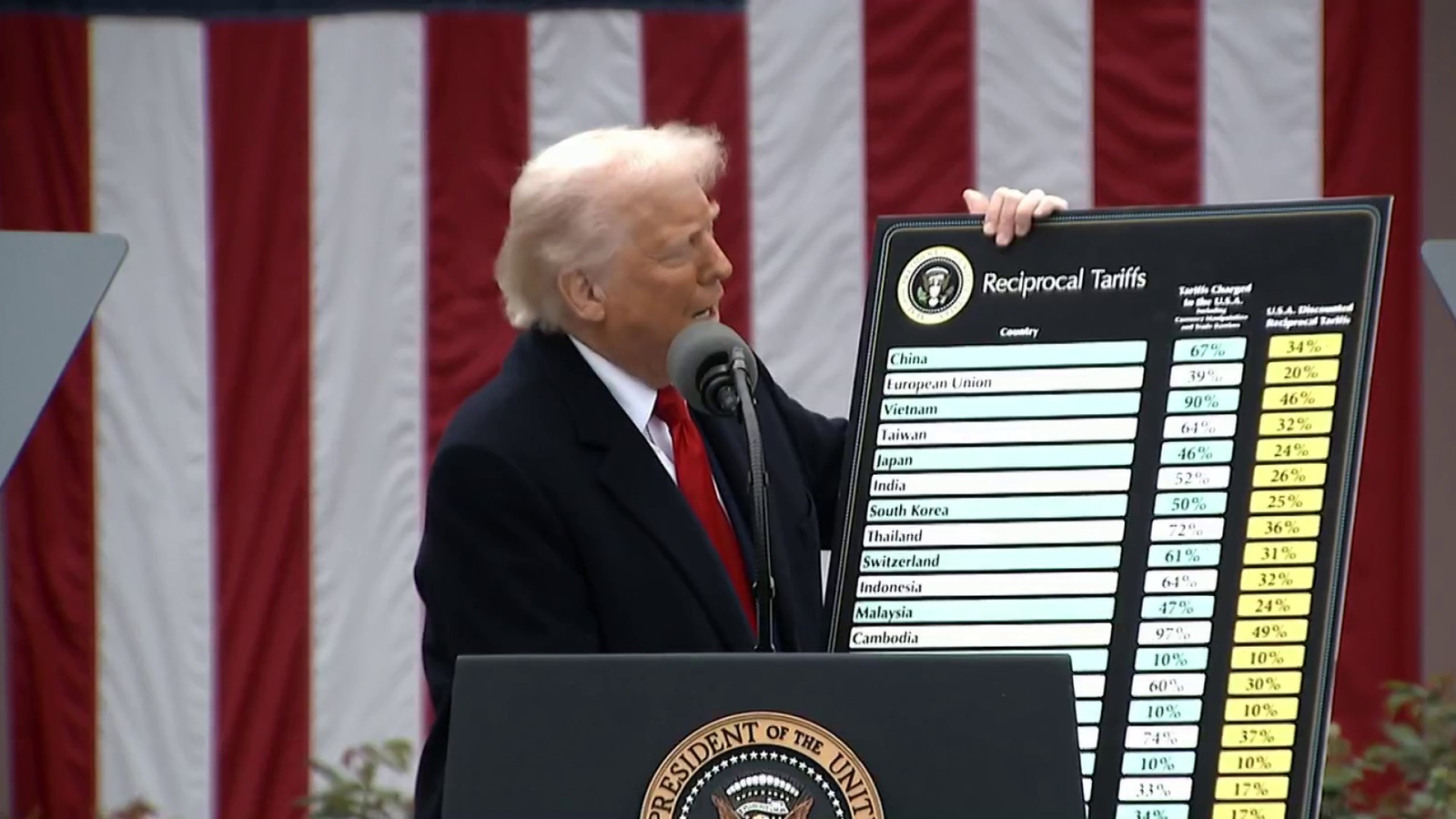

On April 2, 2025, former President Donald Trump announced the immediate implementation of new tariffs, imposing a 25% duty on imported automobiles and auto parts, alongside significant tariffs targeting numerous products across different sectors. This move has triggered discussions regarding its broader economic impact, particularly in the construction, architecture, and real estate sectors. This article explores the projected implications from four key perspectives: economic, industrial, professional, and consumer-based views.

1. Economic Impacts: Inflation and Project Costs

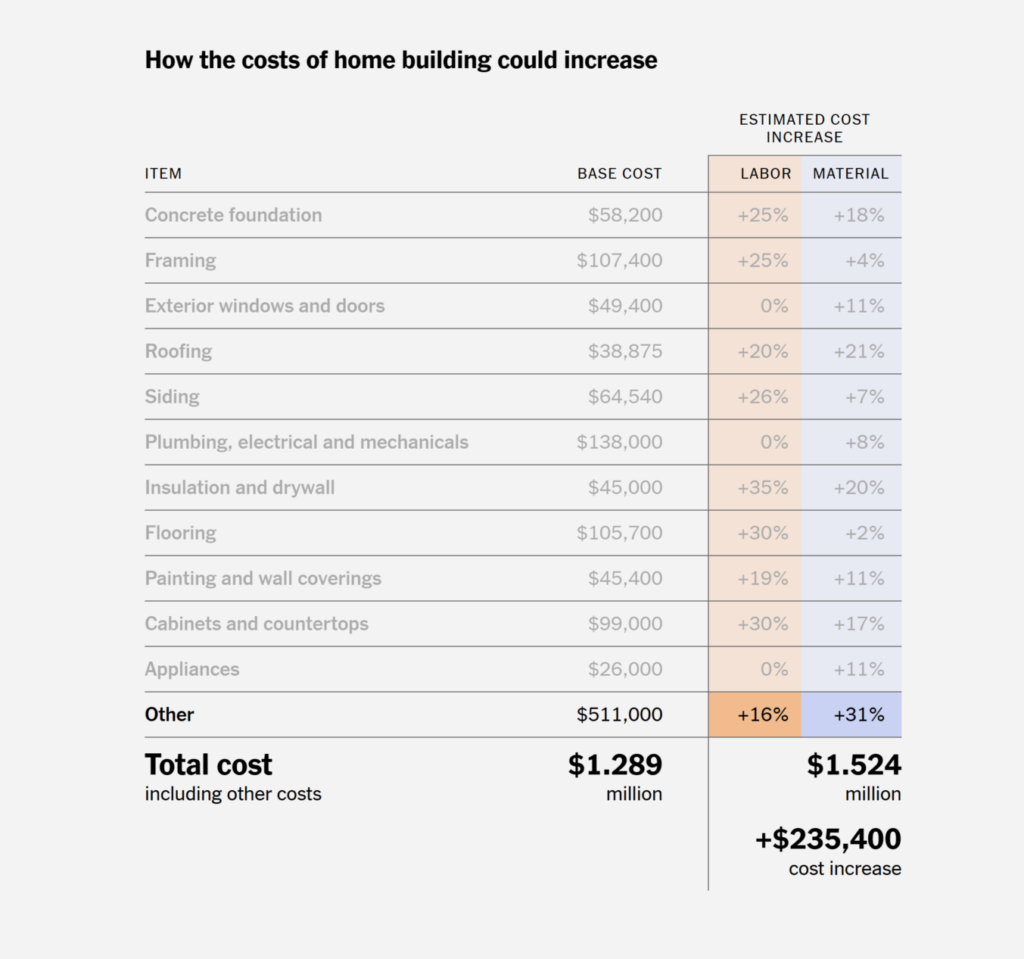

The tariffs are anticipated to cause immediate and substantial economic shifts, potentially raising the overall inflation rate. According to a recent report by CNBC, economists forecast an average increase of approximately 6% in construction material costs, driven predominantly by higher prices of imported steel and aluminum—essential materials for modern infrastructure and real estate developments. This spike may significantly influence project budgeting, potentially curtailing new construction initiatives or delaying ongoing projects.

Further insights by Reuters indicate that automotive tariffs alone could escalate the average car price by around $6,400, directly affecting transportation and logistics costs within construction projects.

2. Industrial Effects: Construction and Supply Chain Disruptions

The construction sector relies heavily on imported materials. Data from Bloomberg highlights that about 30% of U.S. steel and 60% of aluminum are imported, predominantly from Canada, Mexico, and China. These new tariffs are expected to elevate costs dramatically, by as much as 5-8%, forcing construction companies to reconsider their supply chain strategies.

Moreover, disruptions may cascade through supply chains, with Canadian retaliation tariffs already implemented. Prime Minister Justin Trudeau confirmed that 85% of Canadians have already begun boycotting American goods, highlighting a potentially prolonged trade dispute that may further complicate supply availability for North American builders.

3. Professional Implications: Architects and Project Managers Adaptation

For architects and project managers, adapting to increased construction costs presents significant challenges. According to an Archinect analysis, firms will now need to innovate by sourcing alternative, domestically-produced materials or integrating cost-effective sustainable solutions, such as modular or prefabricated construction methods. Norman Foster, renowned architect, stated in a recent webinar that innovative design practices focusing on sustainability and localized resources would become essential to mitigating these new tariff-induced costs.

Project managers, referencing PMI’s April 2025 report, must now reassess budgeting forecasts and project timelines, factoring in potential delays due to material shortages and cost overruns. Strategic risk management and contingency planning will become more crucial than ever to safeguard ongoing and planned construction ventures.

4. Consumer Impact: Higher Real Estate Prices

End-consumers are likely to bear the brunt of these tariff-related cost increases. A MarketWatch survey suggests a potential increase of 8-12% in new home prices over the next 18 months, directly attributable to escalating construction costs. Higher property prices and rent could restrict housing affordability, exacerbating existing housing crises in metropolitan regions such as New York, San Francisco, and Toronto.

Comparative Global Impact: China and Mexico

China, another significant exporter of construction materials to the U.S., faces specific tariffs that could further strain construction supply chains. The China Construction Network forecasts that ongoing trade tensions may reduce Chinese exports to North America by up to 20%, encouraging North American builders to diversify their supply sources toward countries unaffected by the tariffs.

Mexico, also targeted by these tariffs, might experience significant economic repercussions, given that nearly 45% of construction components used in southern U.S. states originate from Mexican factories. A recent Forbes analysis highlights potential production slowdowns in key sectors such as cement, glass, and specialized construction equipment.

Conclusion and Strategic Recommendations

The implementation of these tariffs by former President Trump is likely to reshape the landscape of architecture, construction, and real estate significantly. Firms within these sectors must adopt adaptive and resilient strategies prioritizing local sourcing, sustainability, and innovative construction practices to mitigate adverse impacts.

Industry stakeholders must closely monitor ongoing trade negotiations and economic indicators to remain agile in this challenging environment. With proactive management and innovative approaches, architects, builders, and project managers can navigate these economic disruptions effectively, potentially transforming the industry’s long-term practices and sustainability goals.

Gold prices 3170$ for the ounce

https://www.nytimes.com/interactive/2025/04/01/realestate/trump-tariffs-deportation-house-construction.html

31% material

16% manpower

all this according to NYTimes