JLL: Riyadh’s Real Estate Market Enters a Phase of Structural Transformation

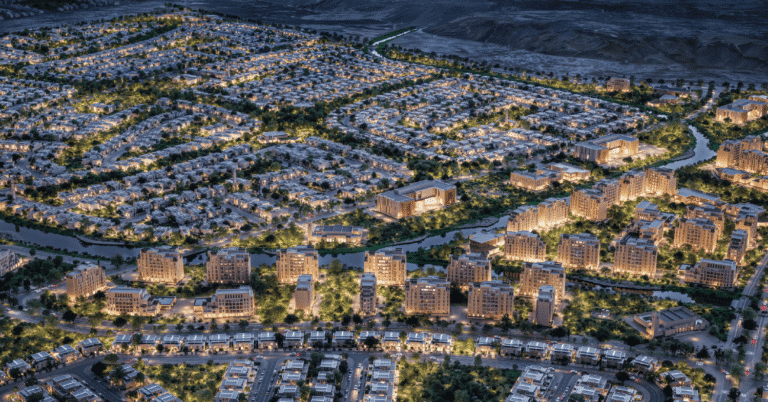

JLL said that Riyadh’s real estate sector is undergoing a phase of structural transformation, driven by the accelerated implementation of Saudi Vision 2030, expanding investment opportunities, and a set of regulatory reforms and government incentives across key sectors.

Regulatory Reforms Reshape the Market

The company noted that key drivers include the implementation of White Land Tax, the freeze on rent increases, and regulatory incentives supporting the public transport sector, all of which have enhanced market efficiency and strengthened investor confidence.

Riyadh Metro Boosts Property Values

According to JLL, the Riyadh Metro, with investments estimated at $25 billion and spanning 176 kilometers, is playing a central role in improving quality of life and supporting the 15-minute city model. Properties located near metro lines are benefiting from price premiums compared to other areas.

Artificial Intelligence as an Economic Catalyst

The firm added that Saudi Arabia’s artificial intelligence sector is growing rapidly, supported by plans to develop a 6-gigawatt data center, positioning the Kingdom as a regional hub for AI-driven computing and providing a new economic catalyst.

Construction Sector Backed by Mega Projects

Regarding the construction sector, JLL highlighted a robust project pipeline supported by mega events and developments, including Expo 2030, the 2034 FIFA World Cup, and King Salman International Airport.

The company estimated the value of Saudi Arabia’s construction sector at around $100 billion in 2025, with expectations of achieving a compound annual growth rate of 5.4% through 2029.

✦ ArchUp Editorial Insight

JLL’s assessment of Riyadh’s real estate sector points to a phase of structural transformation rooted in Contemporary, master-planned urbanism, where regulatory reform and infrastructure investment jointly shape development outcomes. Measures such as the White Land Tax, rent controls, and public transport incentives have redefined market behavior, while the Riyadh Metro emerges as a spatial catalyst reinforcing the 15-minute city model and reshaping land value through new Spatial Dynamics. However, this rapid recalibration invites critical reflection on Contextual Relevance and spatial equity, as transit-led price premiums risk reinforcing uneven development across the urban fabric. At the same time, the convergence of mega projects and AI-driven economic infrastructure signals an expanding Architectural Ambition, positioning Riyadh’s built environment as both a growth engine and a test case for long-term Functional Resilience.