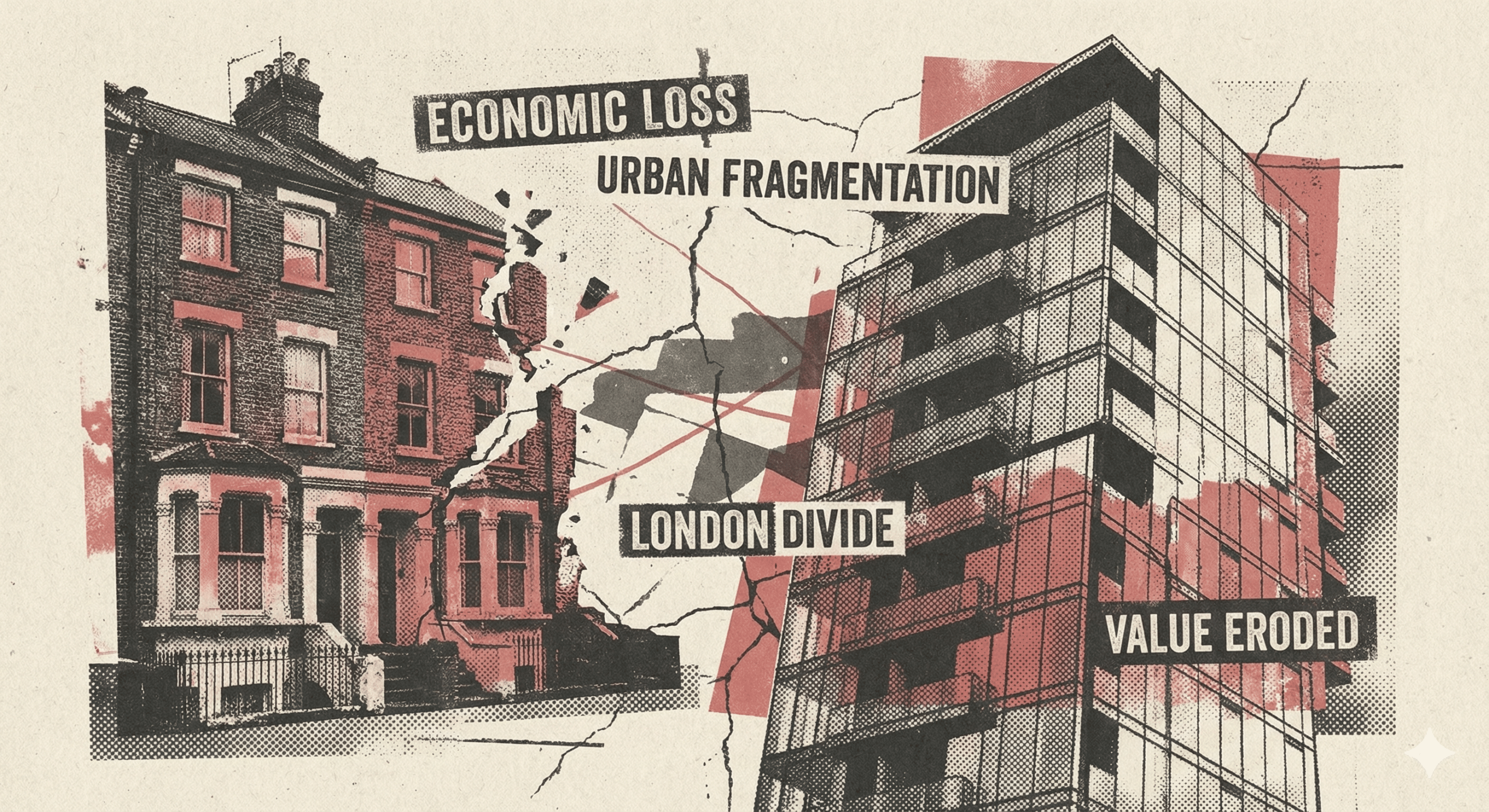

London Becomes the UK City Most Likely for Homes to Be Sold at a Loss

A recent report showed that London has become, for the first time in more than a decade, the city in Britain where homeowners are most likely to sell their properties at a loss, highlighting growing pressure in the housing market.

According to a report by Hamptons, around 15% of home sellers in London sold their properties for less than the original purchase price over the past year, the highest proportion in England, compared with a national average of about 8.7%.

Heavy Discounts and Pressure on Prime Homes

The report noted that some sellers in London were forced to offer significant discounts of up to 50% over the past year in order to complete sales, with expectations of further declines in prime property prices during the current year.

This trend reflects ongoing caution in the market amid economic pressures and tighter financial conditions, weighing on buyer confidence and transaction activity.

Apartments Face Higher Loss Risks

The report also highlighted that sellers of apartments in London were more likely to incur losses than those selling detached houses, due to higher maintenance costs, service charges, and stricter regulations affecting investors in the rental sector.

Market observers say these combined factors have increased financial pressure on owners, prompting some to sell at a loss to reduce long-term liabilities.

2026 Outlook: Flatlining with Pressure on Luxury Market

Market analysts expect 2026 to see flatlining in property price growth, while luxury properties could experience an additional 5% decline due to mansion taxes, as financial pressures continue for high-end apartments and houses in key London areas.

✦ ArchUp Editorial Insight

London’s emergence as the UK city most exposed to loss-making home sales signals a structural shift in its Contemporary urban housing market, where financial dynamics increasingly shape residential value rather than location alone. The data reflects mounting pressure on high-density housing typologies, particularly apartments, as service charges, regulatory constraints, and maintenance costs erode traditional assumptions of capital appreciation. However, while heavy discounts and declining prime values suggest market correction, they also raise questions about the long-term Functional Resilience of London’s residential stock and its alignment with evolving affordability realities. Conversely, the disparity between apartments and detached homes exposes deeper tensions within the Urban Fabric, highlighting how policy, tenure models, and building economics intersect. Ultimately, this moment underscores a recalibration of Contextual Relevance, where housing value is increasingly contingent on adaptability, cost efficiency, and regulatory coherence rather than prestige alone.

✅ Official ArchUp Technical Review completed for this article.